Continue Working Closely with Macau Community to Control COVID-19

Q3 2020 Group Adjusted EBITDA of $(0.9) Billion Improved Vs $(1.4) Billion in Q2 2020

Continue Investing in Macau’s Economic Future by Upgrading Existing Properties & Progressing Phases 3& 4

Effectively Controlling Cost and Remains Well Capitalized

HONG KONG–(BUSINESS WIRE)–Galaxy Entertainment Group (“GEG”, “Company” or the “Group”) (HKEx stock code: 27) today reported results for the three month period ended 30 September 2020. (All amounts are expressed in Hong Kong dollars unless otherwise stated)

LETTER FROM THE CHAIRMAN OF GALAXY ENTERTAINMENT GROUP

I wish to take this opportunity to update you on the status of Macau and the performance of GEG during Q3 2020. COVID-19 has continued to impact the community and businesses globally including Macau and GEG. In Q3 2020, Mainland China, Hong Kong and Macau continued to experience proactive travel restrictions and social distancing measures as they all continued to effectively contain the pandemic. We are pleased that this contributed to the progressive reinstatement of the Individual Visitor Scheme (IVS) in Q3. However, the majority of Mainland cities only resumed IVS applications in late September, therefore visitation was not materially impacted in Q3 which will hopefully continue to ramp up in Q4. Given the subdued revenue and ongoing staff costs, the Group’s Adjusted EBITDA was negative $943 million for the third quarter. This represents a 31% improvement compared to the EBITDA loss reported in Q2, which was largely driven by greater emphasis on cost control.

We again applaud the Macau Government for their decisive and proactive leadership during the challenging COVID-19 crisis. Their focus remains on ensuring the health and safety of the community and economic and social stability of Macau. Their successful efforts contributed to Macau progressively re-opening its borders to China in a managed and sustainable way to ensure the ongoing effective control of COVID-19. GEG certainly supports the Macau Government’s efforts during this critical time.

We believe that when people make future travel plans, health and safety will be foremost in their minds at least until a COVID-19 vaccine is available. Given Macau’s commendable track record of controlling COVID-19, Macau is well positioned to attract visitors from throughout Asia. We continue to make good progress with our development projects including Cotai Phases 3 & 4.

During this period of low visitation to Macau, we have also taken this opportunity to renovate, reconfigure and introduce new products to our resorts to ensure they remain highly competitive and appealing to our guests. Our continuing investment in these projects help support the local economy in the near term and Macau Government’s vision to develop Macau into a World Center of Tourism and Leisure.

In addition, we remain engaged in our international expansion plans particularly in Japan. We understand that COVID-19 has impacted Japan’s timelines and understand that their schedule for accepting applications from local government and consortium parties has been extended to April 2022.

Our balance sheet continues to remain strong with $43.2 billion in cash at the end of Q3 and liquid investments and $39.7 billion of net cash as well as remaining virtually unlevered. This provides us with valuable flexibility in managing operations and supporting our development initiatives.

During this period of low revenue, we have continued to focus on effective cost control versus revenue generation. However, it is important not to cut costs excessively and therefore adversely impact our renowned “World Class, Asian Heart” service standards and customers experience. We remain committed to the Macau Government, local employment and SMEs.

Whilst it is pleasing to see a gradual increase in visitor arrivals to Macau with the reinstatement of IVS, we would expect a gradual increase in visitor arrivals as well as revenue over the coming quarters.

The management and staff continue to work diligently in regards to health, safety and hygiene. The wellbeing of our staff and guests is our highest priority. Furthermore, to support the Macau Government’s fight against COVID-19, the concessionaries of Macau, including GEG have established on-site COVID-19 testing facilities to enable customers to be tested.

As previously stated, GEG takes our corporate social responsibility seriously. It is worth restating that some of our efforts have included making a cash contribution of $100 million, to assist in the fight against COVID-19. In addition, the Galaxy Entertainment Group Foundation subscribed $100 million to a special purpose Macau COVID-19 Recovery Bond. We also donated 1 million face masks, financially contributed to the deep cleaning of 35 local schools, provided numerous food & hygiene hampers to the needy and provided support to the broader community to name a few.

In the medium and longer term, we have great confidence in the future of Macau. We believe that in the shorter term we may experience some challenges as we navigate through COVID-19 and the market will take some time to recover. This is attributable to cautious consumer sentiment in a recovering economy resulting from events such as the COVID-19 pandemic, the Sino-US trade war and an increased focus on capital outflows, among others.

Finally, I would again like to acknowledge and thank the health and emergency personnel who have worked so hard to ensure the safety of Macau. I would also like to thank our staff, management team and Board of Directors who voluntarily contributed to the cost savings program and for being so supportive of our Company during this period of time. Thank you.

Dr. Lui Che Woo

GBM, MBE, JP, LLD, DSSc, DBA

Chairman

Q3 2020 RESULTS HIGHLIGHTS

GEG: Well Capitalized to Weather the Storm

- Q3 Group net revenue of $1.6 billion, down 88% year-on-year and up 34% quarter-on-quarter

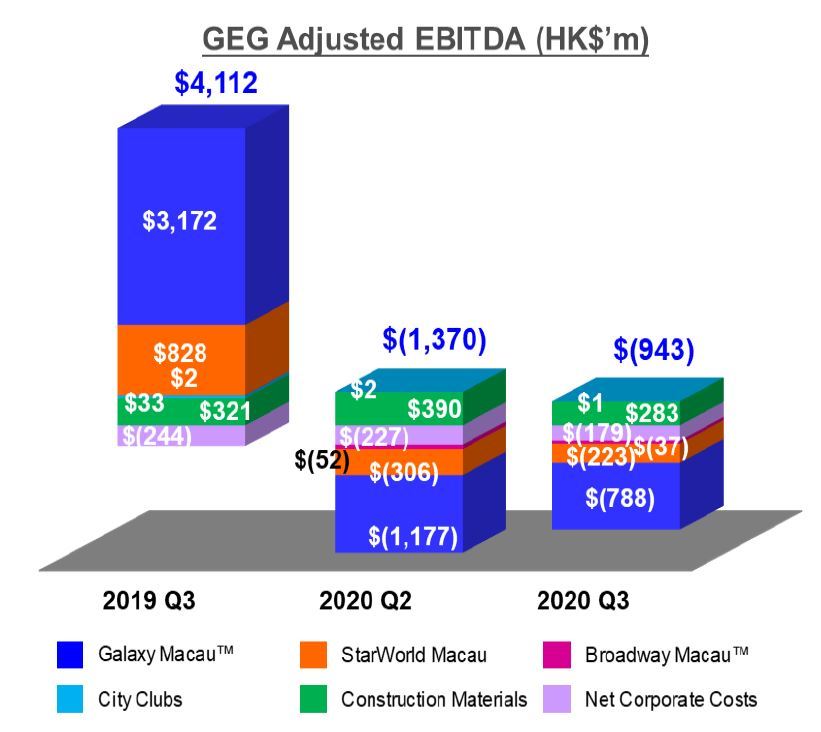

- Q3 Group Adjusted EBITDA of $(943) million, Vs $4,112 million in Q3 2019 and $(1,370) million in Q2 2020

- Played unlucky in Q3 which decreased Adjusted EBITDA by approximately $3 million, normalized Q3 Adjusted EBITDA of $(940) million, Vs $3,928 million in Q3 2019 and $(1,373) million in Q2 2020

- Latest twelve months Adjusted EBITDA of $2.0 billion, down 88% year-on-year and down 71% quarter-on-quarter

Galaxy Macau™: Adjusting Operations to the Current Business Environment

- Q3 net revenue of $626 million, down 93% year-on-year and up 101% quarter-on-quarter

- Q3 Adjusted EBITDA of $(788) million, Vs $3,172 million in Q3 2019 and $(1,177) million in Q2 2020

- Played unlucky in Q3 which decreased Adjusted EBITDA by approximately $1 million, normalized Q3 Adjusted EBITDA of $(787) million, Vs $3,001 million in Q3 2019 and $(1,189) million in Q2 2020

- Hotel occupancy for Q3 across the five hotels was 20%

StarWorld Macau: Adjusting Operations to the Current Business Environment

- Q3 net revenue of $199 million, down 92% year-on-year and up 146% quarter-on-quarter

- Q3 Adjusted EBITDA of $(223) million, Vs $828 million in Q3 2019 and $(306) million in Q2 2020

- Played unlucky in Q3 which decreased Adjusted EBITDA by approximately $2 million, normalized Q3 Adjusted EBITDA of $(221) million, Vs $813 million in Q3 2019 and $(297) million in Q2 2020

- Hotel occupancy for Q3 was 10%

Broadway Macau™: A Unique Family Friendly Resort, Strongly Supported By Macau SMEs

- Q3 net revenue of $13 million Vs $141 million in Q3 2019 and $12 million in Q2 2020

- Q3 Adjusted EBITDA of $(37) million Vs $2 million in Q3 2019 and $(52) million in Q2 2020

- There was no luck impact on Q3 Adjusted EBITDA

- Hotel occupancy for Q3 was 16%

Balance Sheet: Maintain a Healthy and Liquid Balance Sheet

- As at 30 September 2020, cash and liquid investments were $43.2 billion and net cash was $39.7 billion

- As at 30 September 2020, debt of $3.5 billion primarily reflects ongoing treasury yield management initiative

Development Update: Continue to Pursue Development Opportunities

- Continue to make ongoing progressive enhancements to our resorts to ensure that they remain competitive and appealing to our guests

- Cotai Phases 3 & 4 – Continue with development works for Phases 3 & 4, with a strong focus on non-gaming, primarily targeting MICE, entertainment, family facilities and also including gaming, given COVID-19, timelines may be impacted

- Hengqin – Encouraged by recent strengthening of the relationship between Hengqin and Macau, continue with planning of our Hengqin resort

- International – Continuously exploring opportunities in overseas markets, including Japan

Market Overview

The IVS and group tour visas from the Mainland were suspended at the end of January 2020. They were progressively reinstated through the third quarter. However, the majority of Mainland Chinese visitors were not eligible to apply for travel to Macau until late September. Therefore Q3 visitation arrivals remained subdued.

In Q3 2020, visitor arrivals to Macau were 750,204, versus 9,918,273 in Q3 2019 and 49,730 in Q2 2020. Mainland visitor arrivals to Macau were 679,773, versus 7,140,837 in Q3 2019 and 46,360 in Q2 2020.

Based on DICJ reporting, Macau’s Gross Gaming Revenue (“GGR”) for Q3 2020 was $4.7 billion, down 93% year-on-year and up 51% quarter-on-quarter.

Group Financial Results

In Q3 2020, the Group posted net revenue of $1,550 million, down 88% year-on-year and up 34% quarter-on-quarter. Adjusted EBITDA was $(943) million Vs $4,112 million in Q3 2019 and $(1,370) million in Q2 2020. Galaxy Macau™’s Adjusted EBITDA was $(788) million Vs $3,172 million in Q3 2019 and $(1,177) million in Q2 2020. StarWorld Macau’s Adjusted EBITDA was $(223) million Vs $828 million in Q3 2019 and $(306) million in Q2 2020. Broadway Macau™’s Adjusted EBITDA was $(37) million Vs $2 million in Q3 2019 and $(52) million in Q2 2020.

Latest twelve months Adjusted EBITDA was $2.0 billion, down 88% year-on-year and down 71% quarter-on-quarter.

During Q3 2020, GEG experienced bad luck in its gaming operations which decreased Adjusted EBITDA by approximately $3 million. Normalized Q3 2020 Adjusted EBITDA was $(940) million, Vs $3,928 million in Q3 2019 and $(1,373) million in Q2 2020.

The Group’s total GGR on a management basis1 in Q3 2020 was $867 million, down 94% year-on-year and up 79% quarter-on-quarter. Mass GGR was $359 million, down 95% year-on-year and up 160% quarter-on-quarter. VIP GGR was $472 million, down 93% year-on-year and up 50% quarter-on-quarter. Electronic GGR was $36 million, down 94% year-on-year and up 12% quarter-on-quarter.

| Group Key Financial Data |

|

|

|

|||

|

(HK$’m) |

Q3 2019 |

Q2 2020 |

Q3 2020 |

|||

|

Revenues: |

|

|

|

|||

|

Net Gaming |

10,603 |

|

276 |

|

593 |

|

|

Non-gaming |

1,407 |

|

130 |

|

246 |

|

|

Construction Materials |

700 |

|

747 |

|

711 |

|

|

Total Net Revenue |

12,710 |

|

1,153 |

|

1,550 |

|

|

Adjusted EBITDA |

4,112 |

|

(1,370 |

) |

(943 |

) |

|

|

|

|

|

|||

|

Gaming Statistics2 |

|

|

|

|||

|

(HK$’m) |

|

|

|

|||

|

Q3 2019 |

Q2 2020 |

Q3 2020 |

||||

|

Rolling Chip Volume3 |

163,779 |

|

6,704 |

|

11,801 |

|

|

Win Rate % |

3.9 |

% |

4.7 |

% |

4.0 |

% |

|

Win |

6,369 |

|

315 |

|

472 |

|

|

|

|

|

||||

|

Mass Table Drop4 |

30,424 |

|

782 |

|

1,654 |

|

|

Win Rate % |

24.1 |

% |

17.6 |

% |

21.7 |

% |

|

Win |

7,319 |

|

138 |

|

359 |

|

|

|

|

|

||||

|

Electronic Gaming Volume |

17,133 |

|

1,366 |

|

1,324 |

|

|

Win Rate % |

3.7 |

% |

2.4 |

% |

2.7 |

% |

|

Win |

641 |

|

32 |

|

36 |

|

|

|

|

|

|

|||

|

Total GGR Win5 |

14,329 |

|

485 |

|

867 |

|

Balance Sheet

The Group’s balance sheet remains liquid and healthy. As of 30 September 2020, cash and liquid investments were $43.2 billion and net cash was $39.7 billion. Total debt was $3.5 billion, primarily reflects an ongoing treasury management exercise where interest income on cash holdings exceeds corresponding borrowing costs.

Galaxy Macau™

Galaxy Macau™ is the primary contributor to the Group’s revenue and earnings. Net revenue in Q3 2020 was $626 million, down 93% year-on-year and up 101% quarter-on-quarter. Adjusted EBITDA was $(788) million Vs $3,172 million in Q3 2019 and $(1,177) million in Q2 2020.

Galaxy Macau™ experienced bad luck in its gaming operations which decreased its Adjusted EBITDA by approximately $1 million in Q3 2020. Normalized Q3 2020 Adjusted EBITDA was $(787) million, Vs $3,001 million in Q3 2019 and $(1,189) million in Q2 2020.

Hotel occupancy for Q3 2020 across the five hotels was 20%.

|

Galaxy Macau™ Key Financial Data |

|

|

||||

|

(HK$’m) |

|

|

|

|||

|

Q3 2019 |

Q2 2020 |

Q3 2020 |

||||

|

Revenues: |

|

|

|

|||

|

Net Gaming |

8,108 |

|

200 |

|

407 |

|

|

Hotel / F&B / Others |

897 |

|

60 |

|

146 |

|

|

Mall |

310 |

|

51 |

|

73 |

|

|

Total Net Revenue |

9,315 |

|

311 |

|

626 |

|

|

|

|

|

|

|||

|

Adjusted EBITDA |

3,172 |

|

(1,177 |

) |

(788 |

) |

|

Adjusted EBITDA Margin |

34 |

% |

NEG6 |

NEG7 |

||

|

|

|

|

|

|||

|

Gaming Statistics8 |

|

|

|

|||

|

(HK$’m) |

|

|

|

|||

|

Q3 2019 |

Q2 2020 |

Q3 2020 |

||||

|

Rolling Chip Volume9 |

110,279 |

|

5,040 |

|

6,785 |

|

|

Win Rate % |

4.4 |

% |

4.9 |

% |

4.6 |

% |

|

Win |

4,805 |

|

246 |

|

309 |

|

|

|

|

|

||||

|

Mass Table Drop10 |

18,403 |

|

267 |

|

860 |

|

|

Win Rate % |

27.9 |

% |

25.6 |

% |

25.9 |

% |

|

Win |

5,129 |

|

69 |

|

223 |

|

|

|

|

|

||||

|

Electronic Gaming Volume |

11,359 |

|

463 |

|

746 |

|

|

Win Rate % |

4.6 |

% |

2.9 |

% |

3.2 |

% |

|

Win |

523 |

|

14 |

|

23 |

|

|

|

|

|

|

|||

|

Total GGR Win |

10,457 |

|

329 |

|

555 |

|

StarWorld Macau

StarWorld Macau’s net revenue in Q3 2020 was $199 million, down 92% year-on-year and up 146% quarter-on-quarter. Adjusted EBITDA was $(223) million Vs $828 million in Q3 2019 and $(306) million in Q2 2020.

StarWorld Macau experienced bad luck in its gaming operations which decreased its Adjusted EBITDA by approximately $2 million in Q3 2020. Normalized Q3 2020 Adjusted EBITDA was $(221) million, Vs $813 million in Q3 2019 and $(297) million in Q2 2020.

Hotel occupancy was 10% for Q3 2020.

|

StarWorld Macau Key Financial Data |

||||||

|

(HK$’m) |

|

|

|

|||

|

Q3 2019 |

Q2 2020 |

Q3 2020 |

||||

|

Revenues: |

|

|

|

|||

|

Net Gaming |

2,397 |

|

73 |

|

184 |

|

|

Hotel / F&B / Others |

111 |

|

5 |

|

10 |

|

|

Mall |

13 |

|

3 |

|

5 |

|

|

Total Net Revenue |

2,521 |

|

81 |

|

199 |

|

|

|

|

|

|

|||

|

Adjusted EBITDA |

828 |

|

(306 |

) |

(223 |

) |

|

Adjusted EBITDA Margin |

33 |

% |

NEG11 |

NEG12 |

||

|

|

|

|

|

|||

|

Gaming Statistics13 |

|

|

|

|||

|

(HK$’m) |

|

|

|

|||

|

Q3 2019 |

Q2 2020 |

Q3 2020 |

||||

|

Rolling Chip Volume14 |

49,990 |

|

1,216 |

|

4,429 |

|

|

Win Rate % |

2.8 |

% |

4.9 |

% |

3.3 |

% |

|

Win |

1,394 |

|

60 |

|

148 |

|

|

|

|

|

||||

|

Mass Table Drop15 |

8,915 |

|

314 |

|

619 |

|

|

Win Rate % |

19.0 |

% |

11.9 |

% |

16.9 |

% |

|

Win |

1,694 |

|

37 |

|

105 |

|

|

|

|

|

||||

|

Electronic Gaming Volume |

2,226 |

|

211 |

|

155 |

|

|

Win Rate % |

2.5 |

% |

2.6 |

% |

2.3 |

% |

|

Win |

55 |

|

6 |

|

4 |

|

|

|

|

|

|

|||

|

Total GGR Win |

3,143 |

|

103 |

|

257 |

|

Broadway Macau™

Broadway Macau™ is a unique family friendly, street entertainment and food resort supported by Macau SMEs, it does not have a VIP gaming component. Broadway Macau™’s net revenue in Q3 2020 was $13 million, Vs $141 million in Q3 2019 and $12 million in Q2 2020. Adjusted EBITDA was $(37) million Vs $2 million in Q3 2019 and $(52) million in Q2 2020.

There was no luck impact on Broadway Macau™’s Adjusted EBITDA in Q3 2020.

Hotel occupancy was 16% for Q3 2020.

|

Broadway Macau™ Key Financial Data |

||||||

|

(HK$’m) |

|

|

|

|||

|

Q3 2019 |

Q2 2020 |

Q3 2020 |

||||

|

Revenues: |

|

|

|

|||

|

Net Gaming |

65 |

|

1 |

|

1 |

|

|

Hotel / F&B / Others |

66 |

|

7 |

|

6 |

|

|

Mall |

10 |

|

4 |

|

6 |

|

|

Total Net Revenue |

141 |

|

12 |

|

13 |

|

|

|

|

|

|

|||

|

Adjusted EBITDA |

2 |

|

(52 |

) |

(37 |

) |

|

Adjusted EBITDA Margin |

1 |

% |

NEG16 |

NEG17 |

||

|

|

|

|

|

|||

|

Gaming Statistics18 |

|

|

|

|||

|

(HK$’m) |

|

|

|

|||

|

Q3 2019 |

Q2 2020 |

Q3 2020 |

||||

|

Mass Table Drop19 |

329 |

|

NIL* |

NIL* |

||

|

Win Rate % |

19.2 |

% |

NIL* |

NIL* |

||

|

Win |

63 |

|

NIL* |

NIL* |

||

|

|

|

|

||||

|

Electronic Gaming Volume |

454 |

|

74 |

|

36 |

|

|

Win Rate % |

2.3 |

% |

2.1 |

% |

2.4 |

% |

|

Win |

10 |

|

1 |

|

1 |

|

|

|

|

|

|

|||

|

Total GGR Win |

73 |

|

1 |

|

1 |

|

* NIL represents tables not opened during the period.

City Clubs

In Q3 2020, City Clubs contributed $1 million of Adjusted EBITDA to the Group’s earnings, down 97% year-on-year and down 50% quarter-on-quarter.

|

City Clubs Key Financial Data |

|

|

||||

|

(HK$’m) |

|

|

|

|||

|

Q3 2019 |

Q2 2020 |

Q3 2020 |

||||

|

Adjusted EBITDA |

33 |

|

2 |

|

1 |

|

|

|

|

|

|

|||

|

Gaming Statistics20 |

|

|

|

|||

|

(HK$’m) |

|

|

|

|||

|

Q3 2019 |

Q2 2020 |

Q3 2020 |

||||

|

Rolling Chip Volume21 |

3,510 |

|

448 |

|

587 |

|

|

Win Rate % |

4.9 |

% |

2.0 |

% |

2.4 |

% |

|

Win |

170 |

|

9 |

|

15 |

|

|

|

|

|

||||

|

Mass Table Drop22 |

2,777 |

|

201 |

|

175 |

|

|

Win Rate % |

15.6 |

% |

15.6 |

% |

17.8 |

% |

|

Win |

433 |

|

32 |

|

31 |

|

|

|

|

|

||||

|

Electronic Gaming Volume |

3,094 |

|

618 |

|

387 |

|

|

Win Rate % |

1.7 |

% |

1.9 |

% |

2.0 |

% |

|

Win |

53 |

|

11 |

|

8 |

|

|

|

|

|

|

|||

|

Total GGR Win |

656 |

|

52 |

|

54 |

|

Construction Materials Division

The Construction Materials Division contributed Adjusted EBITDA of $283 million in Q3 2020, down 12% year-on-year and down 27% quarter-on-quarter.

Development Update

Galaxy Macau™ and StarWorld Macau

We continue to make ongoing progressive enhancements to our resorts to ensure that they remain competitive and appealing to our guests.

Cotai – The Next Chapter

GEG is uniquely positioned for long term growth. We are proceeding with the development of Phases 3 & 4 and continue to review and refine plans to ensure a world-class optimal development including, for the time being, approximately 3,500 high end and family rooms and villas, 400,000 square feet of MICE space, a 500,000 square feet 16,000-seat multi-purpose arena, F&B, retail and casinos, among others. We will try to maintain our development targets, however due to COVID-19, development timelines may be impacted. At this point we cannot quantify the impact but we will endeavor to maintain our schedule.

Hengqin

We continue to make progress with our concept plan for a lifestyle resort on Hengqin that will complement our high energy resorts in Macau. We welcome the proactive efforts recently made by the Macau Government to show a stronger presence for the integration of Macau and Hengqin. Also, we are encouraged by the opening of the new Hengqin immigration port and the extension line of Zhuhai Urban-Airport Mass Rapid Transit in August 2020. We look forward to working with respective governments to develop our plan in Hengqin and support the government’s strategy to diversify Macau’s economy.

International

Our Japan based team continues with our Japan development efforts even as they deal with the COVID-19 crisis. We view Japan as a great long term growth opportunity that will complement our Macau operations and our other international expansion ambitions. GEG, together with Monte-Carlo SBM from the Principality of Monaco and our Japanese partners, look forward to bringing our brand of World Class IRs to Japan.

Selected Major Awards through Q3 2020

|

Award |

Presenter |

|

GEG |

|

|

Casino Operator of the Year Australia & Asia |

13th International Gaming Awards |

|

Socially Responsible Operator (Asia / Australia) |

|

|

Social Responsibility Award |

The 2nd Greater China’s Most Influential |

|

Certificate of Excellence in Investor Relations |

HKIRA 6th Investor Relations Awards |

|

Galaxy MacauTM |

|

|

Best of the Best Awards Top 10 Hotels for Families – China |

|

|

|

|

|

Travelers’ Choice Winner: |

|

|

Hotels: |

|

|

– The Ritz-Carlton, Macau |

|

|

– Banyan Tree Macau |

|

|

– Hotel Okura Macau |

|

|

– JW Marriott Hotel Macau |

|

|

Restaurants: |

Tripadvisor 2020 Travelers’ Choice |

|

– 8½ Otto e Mezzo BOMBANA |

|

|

– CHA BEI |

|

|

– CAFÉ DE PARIS MONTE-CARLO |

|

|

– Festiva |

|

|

– Passion by Gérard Dubois |

|

|

– The Macallan Whisky Bar & Lounge |

|

|

– Belon |

|

|

– Saffron |

|

|

– The Lounge (JW Marriott Hotel Macau) |

|

|

– Man Ho Chinese Restaurant |

|

|

– Lai Heen |

|

|

– The Ritz-Carlton Café |

|

|

– The Ritz-Carlton Bar & Lounge |

|

|

Loved by Guests Award 2020 |

Hotels.com |

|

Most Anticipated Hotel – Andaz Macau |

|

|

Most Anticipated Convention Center |

2020 Golden Five Stars Award by China |

|

– Galaxy International Convention Center |

|

|

My Favorite Hotel Restaurant in Macau – Fook Lam Moon |

U Magazine Favorite Food Awards 2020 |

|

2019 Macau Green Hotel Awards – Gold Award |

|

|

– Banyan Tree Macau |

DSPA & MGTO |

|

– JW Marriott Hotel Macau |

|

|

– The Ritz-Carlton, Macau |

|

|

Annual Gourmet Landmark – Galaxy MacauTM |

2019-2020 China Feast Restaurant |

|

Special Recommended Must Eat Restaurant – Fook Lam Moon |

|

|

StarWorld Macau |

|

|

My Favorite Hotel Restaurant in Macau – Feng Wei Ju |

U Magazine Favorite Food Awards 2020 |

|

|

|

|

I Food Award 2020 – My Favorite Restaurant in Hotel – Feng Wei Ju |

I Food Award |

|

Broadway MacauTM |

|

|

Agoda Customer Review Award 2020 |

Agoda.com |

|

Travelers’ Choice Winner |

TripAdvisor 2020 Travelers’ Choice |

|

Construction Materials Division |

|

|

Good MPF Employer Award 2019-20: |

|

|

– Good MPF Employer Award Logo |

Mandatory Provident Fund Schemes |

|

– e- Contribution Award |

Authority |

|

– MPF Support Award |

|

|

|

|

|

Good Employer Charter 2020: |

|

|

– Signatory of the Good Employer Charter 2020 |

Labour Department |

|

– Family-friendly Good Employer Logo |

|

|

Hong Kong Green Organisation |

Environmental Campaign Committee |

|

Construction Industry Caring Organisation |

Construction Industry Sports and |

We believe that COVID-19 will continue to impact Macau for the immediate future. Mainland China, Hong Kong and Macau continue to experience travel restrictions which have been easing and social distancing measures. We are pleased with the progressive reinstatement of the IVS and group travel visas in Mainland through Q3, however the majority of Mainland cities only resumed IVS applications in late September. Therefore, we expect visitation to improve as Macau benefits from the ramping up of the IVS program. In the medium to longer term, we have great confidence in the future of Macau.

The expanded infrastructure has and will continue to improve the accessibility to Macau. In particular, the new Hengqin immigration port and the extension line of Zhuhai Urban-Airport Mass Rapid Transit which commenced operation in August 2020. Also, the Macau Government plans to repurpose part of the Taipa Ferry Terminal into the second terminal building of the Macau International Airport and increase the total airport capacity. The Macau Government also plans to build the east section of the Light Rail Transport which will connect the peninsula’s Gongbei Border Gate checkpoint to the Taipa Ferry Terminal.

We believe that when Mainland and international tourists make travel plans in the future, health and safety will be foremost in their minds at least until a COVID-19 vaccine is available. Given Macau’s track record of controlling COVID-19, Macau is well-positioned to attract visitors from throughout Asia.

Specifically, to GEG, the Group is well positioned to capture future growth with our substantial development pipeline. These include the ongoing development of Cotai Phases 3 & 4 which are specifically designed to capture a larger share of the Mass business. During this period of low visitation to Macau, we have taken this opportunity to renovate, reconfigure and introduce new products to our resorts to ensure they remain highly competitive and appealing to our valuable guests. These projects will support Macau’s economy in the near term. Longer term, GEG remains committed to support the Government’s vision to develop Macau into a World Center of Tourism and Leisure.

We remain engaged in our international expansion plans particularly in Japan. We understand that Japan has revised their timeline of Integrated Resorts licenses and we remain interested in introducing our brands to Japan.

Through our prudent business management, GEG has a strong and virtually unlevered balance sheet. This allows us to continue to invest into and upgrade our existing resorts and proceed with the planned opening of Cotai Phases 3 & 4. During the period of low revenue, we will continue to focus on effective cost control. However, we are mindful not to cut costs excessively and therefore adversely impact our renowned “World Class, Asian Heart” service standards and customers experience.

About Galaxy Entertainment Group (HKEx stock code: 27)

Galaxy Entertainment Group (“GEG” or the “Group”) is one of the world’s leading resorts, hospitality and gaming companies. It primarily develops and operates a large portfolio of integrated resort, retail, dining, hotel and gaming facilities in Macau. The Group is listed on the Hong Kong Stock Exchange and is a constituent stock of the Hang Seng Index.

GEG is one of the three original concessionaires in Macau with a successful track record of delivering innovative, spectacular and award-winning properties, products and services, underpinned by a “World Class, Asian Heart” service philosophy, that has enabled it to consistently outperform the market in Macau.

GEG operates three flagship destinations in Macau: on Cotai, Galaxy Macau™, one of the world’s largest integrated destination resorts, and the adjoining Broadway Macau™, a unique landmark entertainment and food street destination; and on the Peninsula, StarWorld Macau, an award winning premium property.

Contacts

For Media Enquiries:

Galaxy Entertainment Group – Investor Relations

Mr. Peter J. Caveny / Ms. Yoko Ku / Ms. Joyce Fung

Tel: +852 3150 1111

Email: ir@galaxyentertainment.com